Ethereum's Next Chapter: Treasury Innovation, 10-Year Uptime, and a Surging Market Narrative

As Ethereum ($ETH) approaches a major milestone — its 10th anniversary — it's not just a celebration of uptime, but a turning point in how institutions and investors view the asset. From the rise of yield-generating $ETH treasuries to market-defining legislation and long-term valuation forecasts, $ETH is entering a new era.

Ethereum Treasuries: Yield Comes with Risk

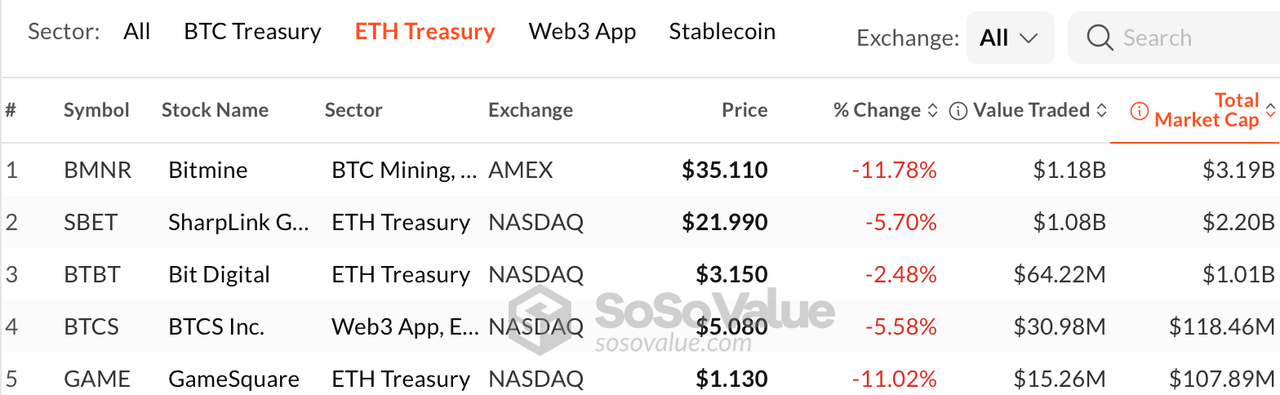

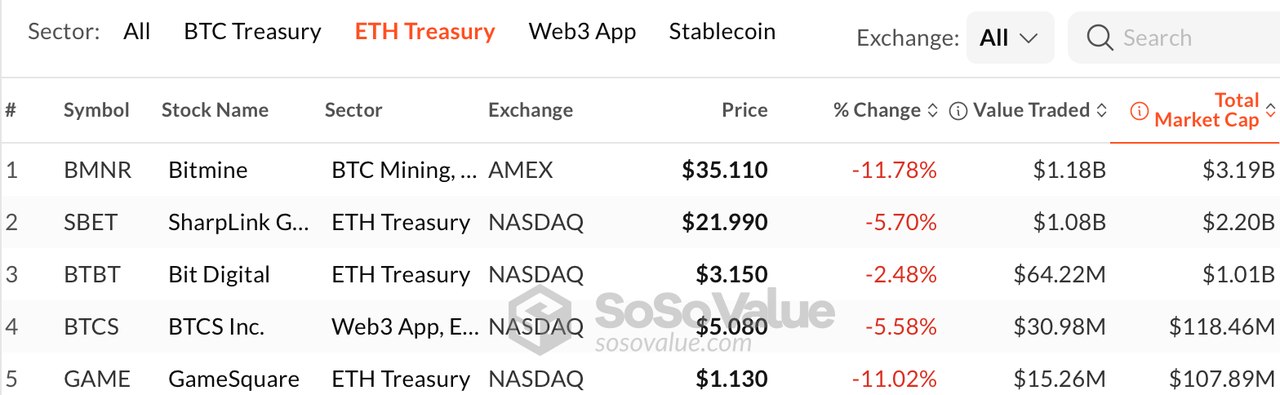

According to a recent Bernstein report, Ethereum-focused companies are diverging from their Bitcoin counterparts by not just holding $ETH as a reserve asset, but actively staking it to earn yield — a strategy that introduces both upside and new risk.

- As of July, Ethereum treasury holdings have reached 876,000 $ETH, led by firms like SharpLink Gaming (SBET), Bit Digital (BTBT), and BitMine Immersion (BMNR).

- BMNR alone holds over $2 billion in $ETH and aims to accumulate and stake 5% of $ETH’s total supply.

While staking provides treasury yield, analysts caution against underestimating its tradeoffs:

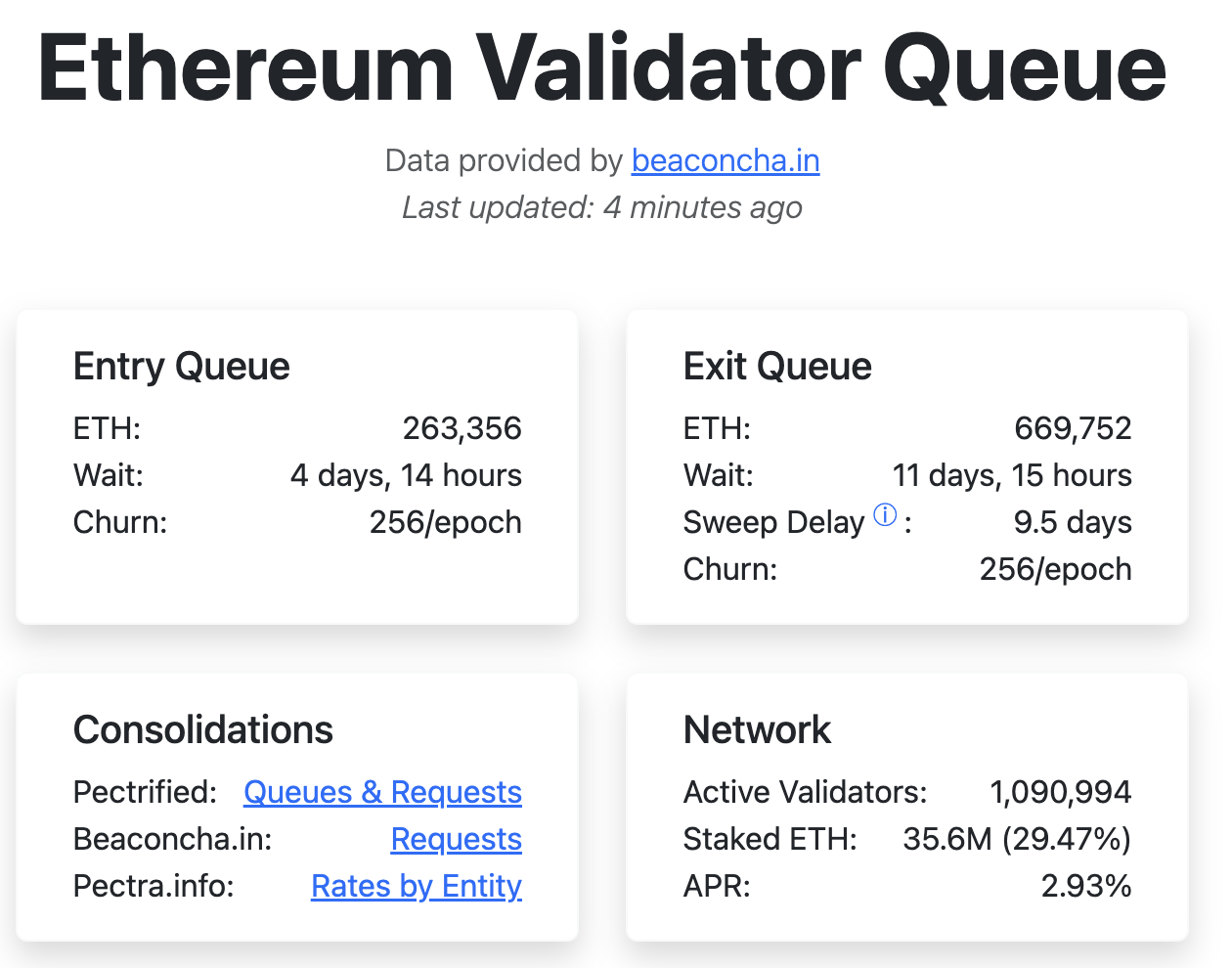

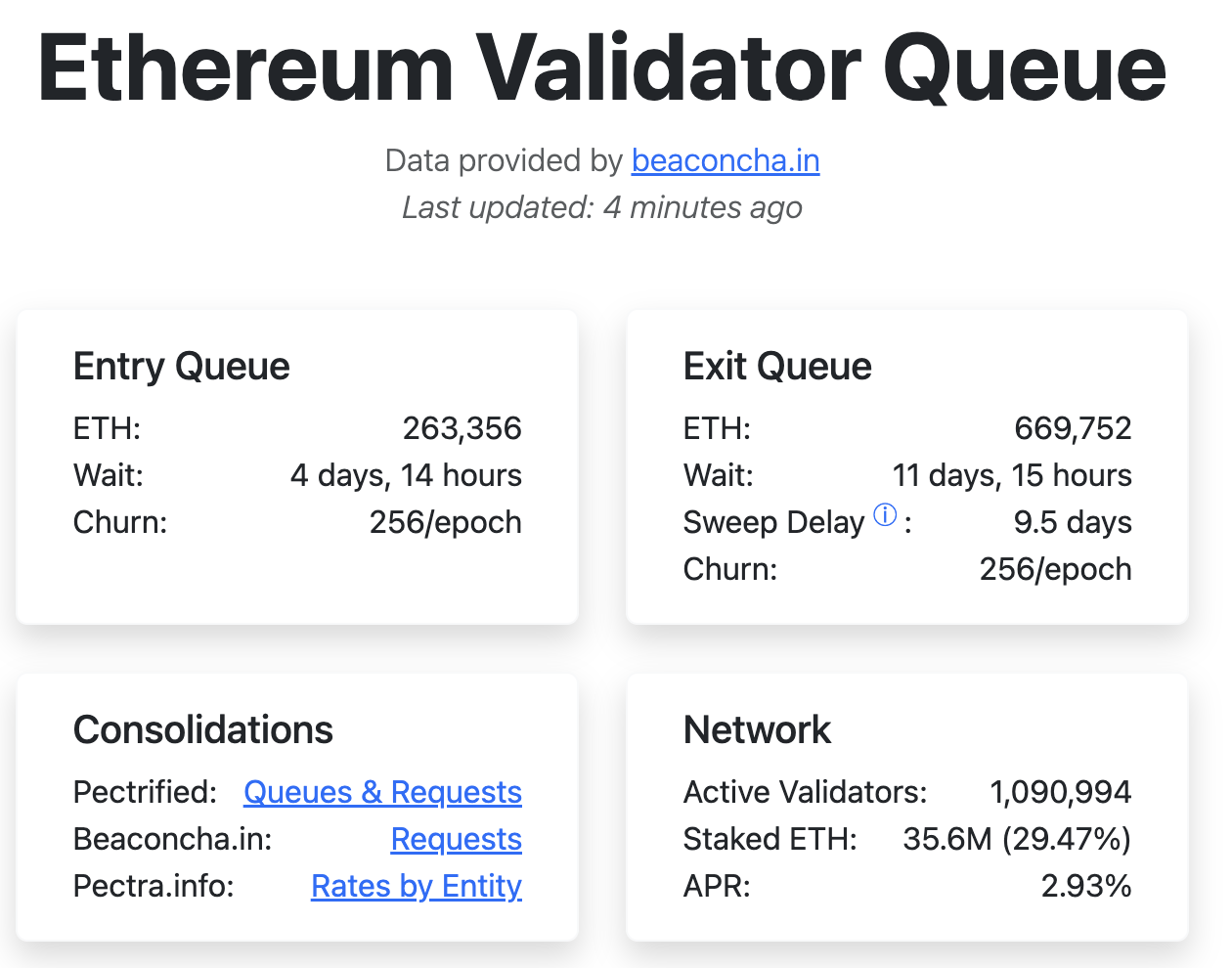

- Liquidity risks: $ETH staking contracts may take days to exit. This creates a mismatch for companies managing real-world liabilities and treasury rebalancing needs.

- Smart contract risk: More complex strategies like Eigenlayer restaking or DeFi-based yield farming increase vulnerability to code exploits or protocol failures.

Bernstein contrasts this model with Strategy (formerly MicroStrategy), which holds nearly $72 billion in BTC but refuses to stake or lend it out. Strategy prioritizes liquidity and risk management, using flexible debt/equity funding to remain agile.

$ETH Price Momentum: On-Chain Fundamentals Meet Macro Tailwinds

$ETH broke $3,900 this week—its highest since December — and is up more than 50% in the past month. Analysts point to several converging catalysts:

- The $ETH Treasury model is gaining institutional traction.

- The recent passage of the GENIUS Act in the U.S. has improved the regulatory outlook for Ethereum and Layer-2 infrastructure.

- $ETH’s tokenomics flywheel—staking yield driven by transaction fees and supply burn via EIP-1559—continues to strengthen $ETH’s monetary narrative.

Forward-looking predictions are equally bullish:

- BitMEX founder Arthur Hayes expects $ETH to hit $10,000 in 2025.

- BMNR Chairman Tom Lee suggested $ETH could surge to $60,000, based on internal "replacement value" assessments. While the firm has obvious exposure, the valuation framework reflects growing confidence in $ETH's economic relevance.

Ten Years Online: Ethereum Hits Milestone With Zero Downtime

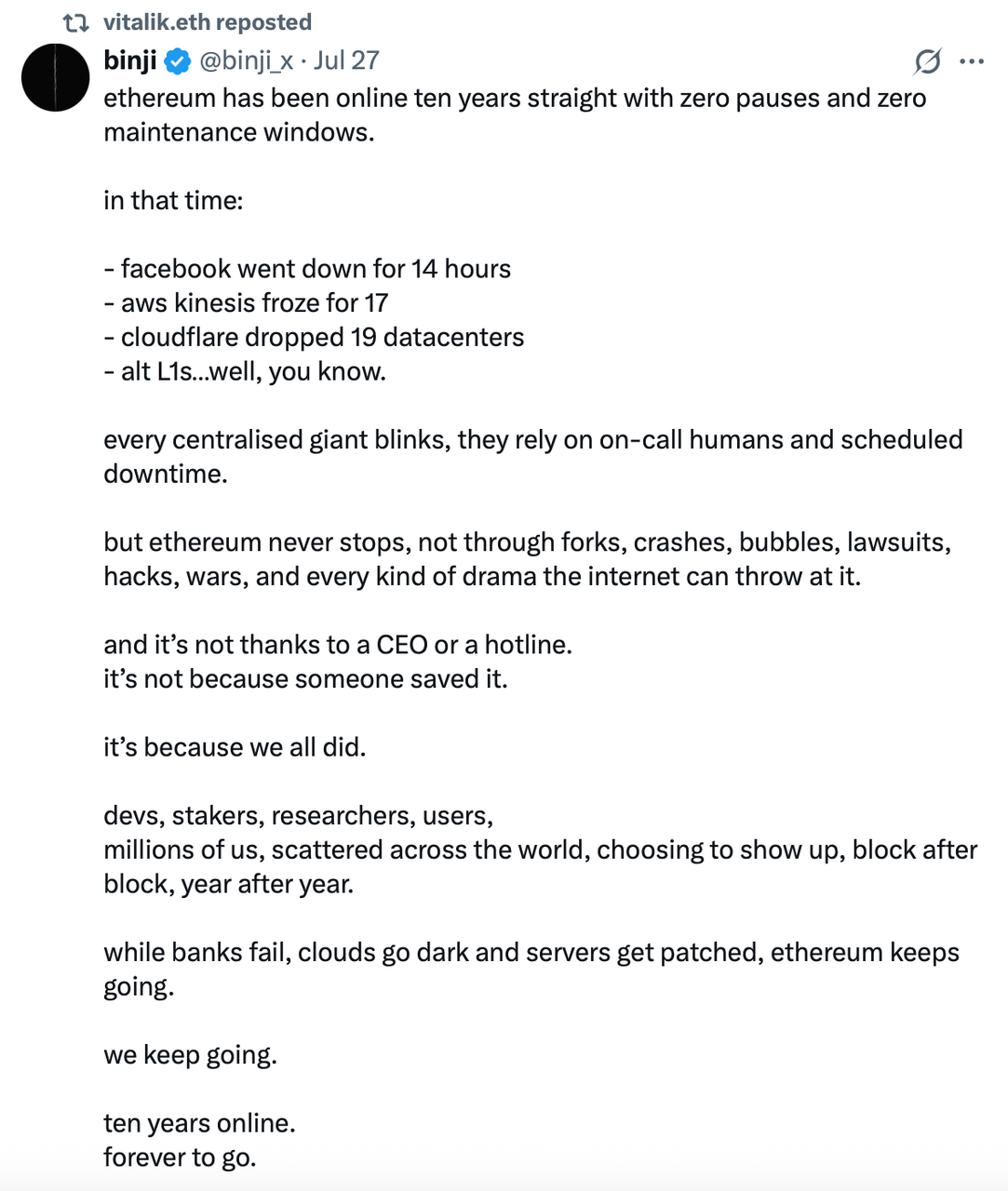

As Ethereum nears its 10-year anniversary, community members are celebrating an unprecedented streak: zero downtime since launch.

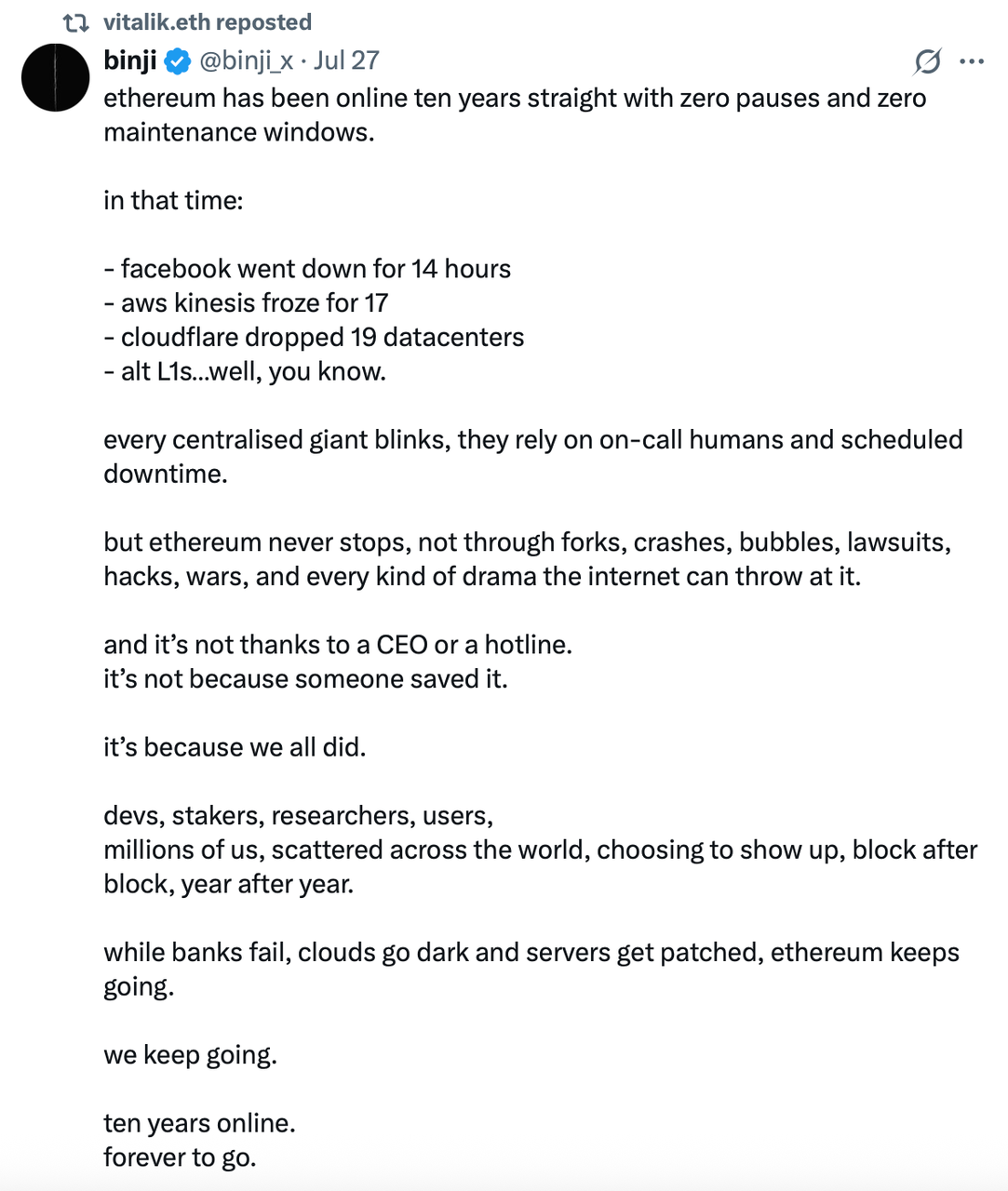

- Developer and Optimism contributor Binji Pande emphasized Ethereum’s resilience: “In 10 years, Facebook went down 14 hours, AWS froze for 17, Cloudflare lost 19 data centers… but Ethereum never stopped. Not once.”

- This performance is attributed not to centralized engineering teams but to Ethereum’s decentralized, global network of developers, stakers, researchers, and users.

To mark the occasion, the Ethereum Foundation launched an NFT torch campaign. The token passes hands every 24 hours, symbolizing the community’s collective resilience. Notable holders include Ethereum co-founder Joseph Lubin, Curve Finance founder Michael Egorov, and Ukraine’s Deputy Minister of Digital Transformation Alex Bornyakov.

Still Debated: Scaling, Centralization, and Regulatory Uncertainty

Not everyone buys the “unstoppable Ethereum” narrative.

- Analyst Marty Party argues Ethereum’s 13 TPS is hardly scalable and criticizes L2s as centralized sequencers, not true blockchains. “They’re just batching pseudo-transactions, escrowed for seven days,” he said.

- He also warned that many assets built on ETH-based protocols could be classified as unregistered securities under U.S. law, calling for caution until legislation like the Market Structure Act and Clarity Act are finalized.

While Ethereum’s foundation celebrates uptime, the debate around its scalability and legal clarity remains far from settled.

The Bigger Picture: Ethereum as a Yield-Generating Internet Asset

Ethereum is evolving—from an experimental smart contract platform to a foundational financial asset with real cash flow, institutional demand, and macroeconomic relevance.

The $ETH treasury model may mirror Bitcoin’s early corporate playbook, but with higher yield comes higher risk. As companies chase staking returns, they must navigate smart contract complexity, liquidity management, and a shifting legal landscape.

Whether Ethereum becomes the world’s “internet bond” or buckles under its own weight will depend on how well it balances decentralization, scalability, and financial utility in the years ahead.

Ethereum's Next Chapter: Treasury Innovation, 10-Year Uptime, and a Surging Market Narrative

As Ethereum (ETH) approaches a major milestone — its 10th anniversary — it's not just a celebration of uptime, but a turning point in how institutions and investors view the asset. From the rise of yield-generating ETH treasuries to market-defining legislation and long-term valuation forecasts, ETH is entering a new era.

Ethereum Treasuries: Yield Comes with Risk

According to a recent Bernstein report, Ethereum-focused companies are diverging from their Bitcoin counterparts by not just holding ETH as a reserve asset, but actively staking it to earn yield — a strategy that introduces both upside and new risk.

- As of July, Ethereum treasury holdings have reached 876,000 ETH, led by firms like SharpLink Gaming (SBET), Bit Digital (BTBT), and BitMine Immersion (BMNR).

- BMNR alone holds over $2 billion in ETH and aims to accumulate and stake 5% of ETH’s total supply.

While staking provides treasury yield, analysts caution against underestimating its tradeoffs:

- Liquidity risks: ETH staking contracts may take days to exit. This creates a mismatch for companies managing real-world liabilities and treasury rebalancing needs.

- Smart contract risk: More complex strategies like Eigenlayer restaking or DeFi-based yield farming increase vulnerability to code exploits or protocol failures.

Bernstein contrasts this model with Strategy (formerly MicroStrategy), which holds nearly $72 billion in BTC but refuses to stake or lend it out. Strategy prioritizes liquidity and risk management, using flexible debt/equity funding to remain agile.

ETH Price Momentum: On-Chain Fundamentals Meet Macro Tailwinds

ETH broke $3,900 this week—its highest since December — and is up more than 50% in the past month. Analysts point to several converging catalysts:

- The ETH Treasury model is gaining institutional traction.

- The recent passage of the GENIUS Act in the U.S. has improved the regulatory outlook for Ethereum and Layer-2 infrastructure.

- ETH’s tokenomics flywheel—staking yield driven by transaction fees and supply burn via EIP-1559—continues to strengthen ETH’s monetary narrative.

Forward-looking predictions are equally bullish:

- BitMEX founder Arthur Hayes expects ETH to hit $10,000 in 2025.

- BMNR Chairman Tom Lee suggested ETH could surge to $60,000, based on internal "replacement value" assessments. While the firm has obvious exposure, the valuation framework reflects growing confidence in ETH's economic relevance.

Ten Years Online: Ethereum Hits Milestone With Zero Downtime

As Ethereum nears its 10-year anniversary, community members are celebrating an unprecedented streak: zero downtime since launch.

- Developer and Optimism contributor Binji Pande emphasized Ethereum’s resilience: “In 10 years, Facebook went down 14 hours, AWS froze for 17, Cloudflare lost 19 data centers… but Ethereum never stopped. Not once.”

- This performance is attributed not to centralized engineering teams but to Ethereum’s decentralized, global network of developers, stakers, researchers, and users.

To mark the occasion, the Ethereum Foundation launched an NFT torch campaign. The token passes hands every 24 hours, symbolizing the community’s collective resilience. Notable holders include Ethereum co-founder Joseph Lubin, Curve Finance founder Michael Egorov, and Ukraine’s Deputy Minister of Digital Transformation Alex Bornyakov.

Still Debated: Scaling, Centralization, and Regulatory Uncertainty

Not everyone buys the “unstoppable Ethereum” narrative.

- Analyst Marty Party argues Ethereum’s 13 TPS is hardly scalable and criticizes L2s as centralized sequencers, not true blockchains. “They’re just batching pseudo-transactions, escrowed for seven days,” he said.

- He also warned that many assets built on ETH-based protocols could be classified as unregistered securities under U.S. law, calling for caution until legislation like the Market Structure Act and Clarity Act are finalized.

While Ethereum’s foundation celebrates uptime, the debate around its scalability and legal clarity remains far from settled.

The Bigger Picture: Ethereum as a Yield-Generating Internet Asset

Ethereum is evolving—from an experimental smart contract platform to a foundational financial asset with real cash flow, institutional demand, and macroeconomic relevance.

The ETH treasury model may mirror Bitcoin’s early corporate playbook, but with higher yield comes higher risk. As companies chase staking returns, they must navigate smart contract complexity, liquidity management, and a shifting legal landscape.

Whether Ethereum becomes the world’s “internet bond” or buckles under its own weight will depend on how well it balances decentralization, scalability, and financial utility in the years ahead.

00:00

00:00