stETH колеблется, но уверенность ETH сильна как никогда

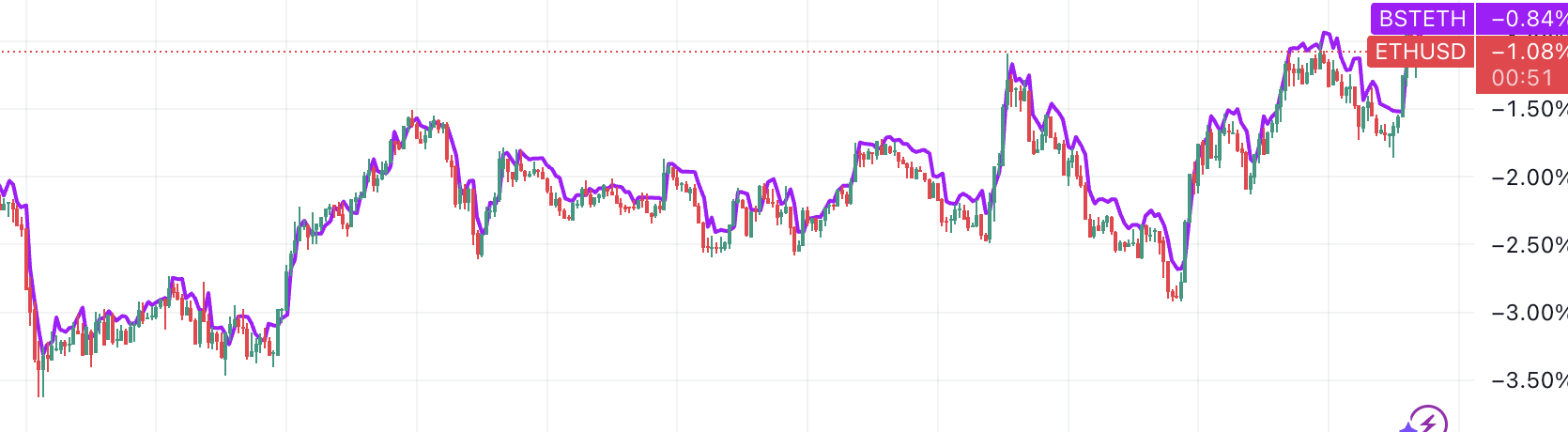

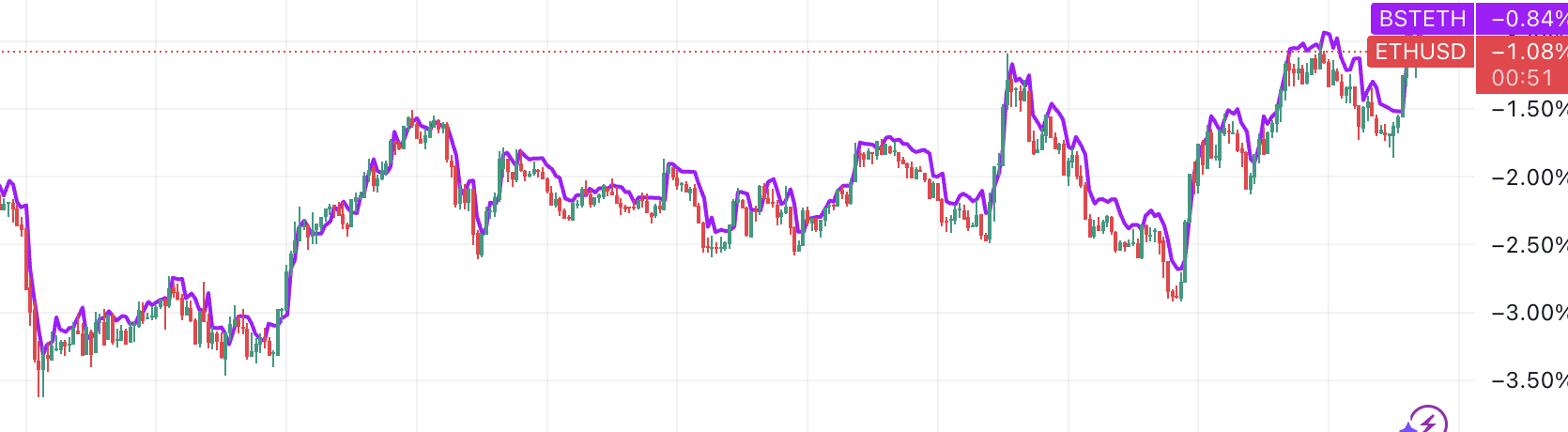

So yeah, we just saw a classic DeFi loop unwind — stETH depegged a bit as Aave’s WETH borrow rate spiked, triggering some forced unwinds and panic selling. Nothing new here. It's what you get when you pile leverage on top of leverage.

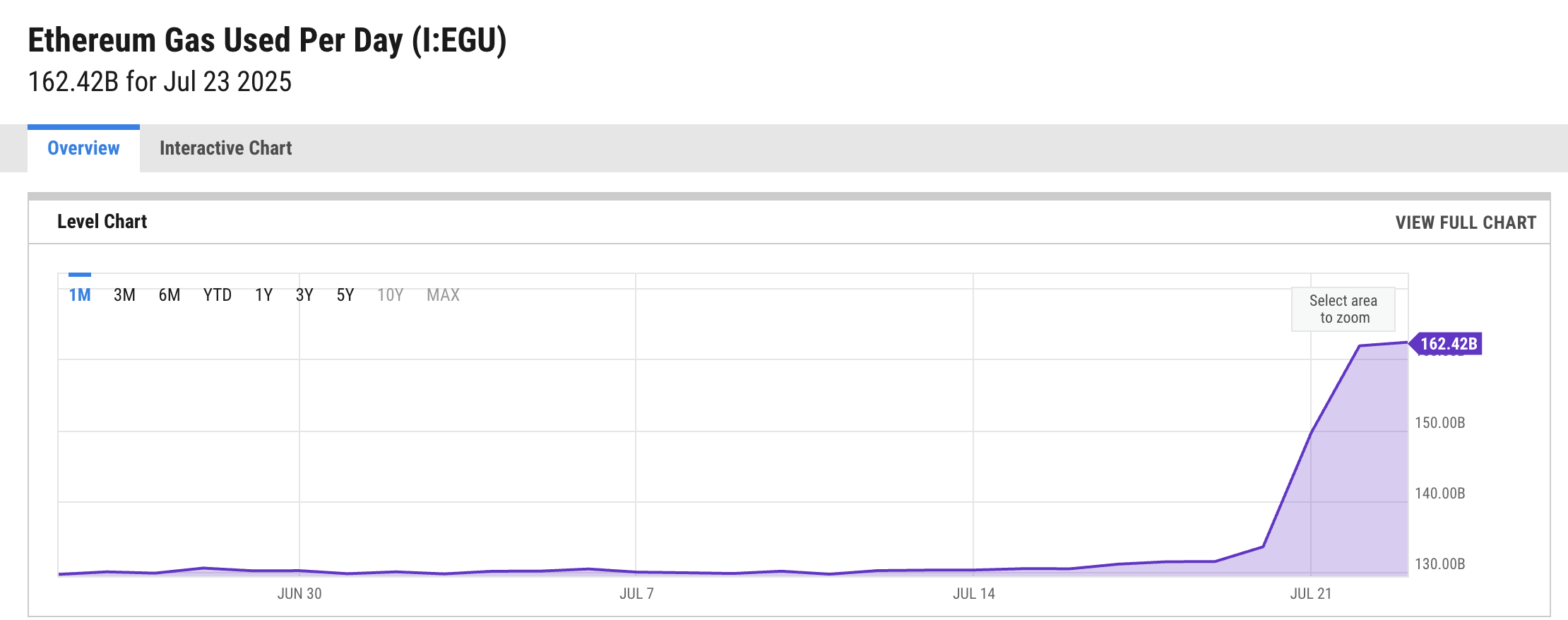

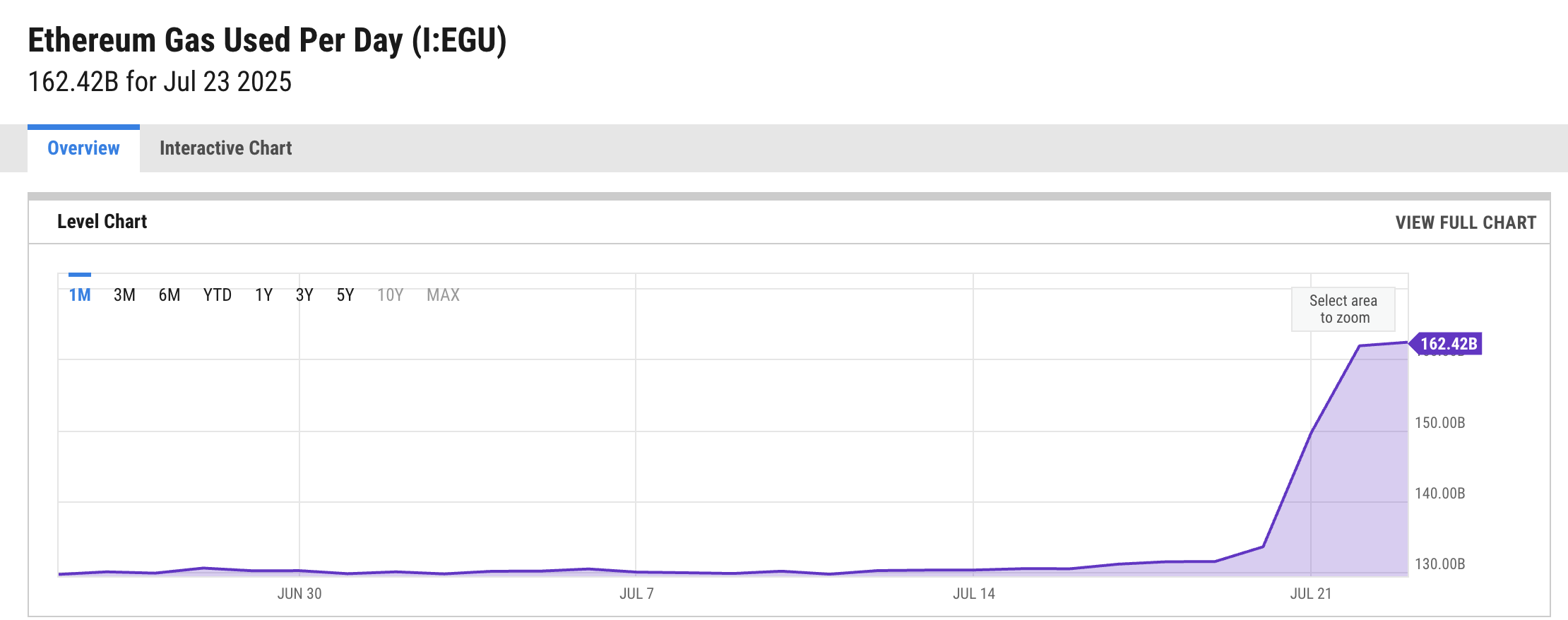

But zoom out — Ethereum just hit an all-time high in daily gas usage. That’s not just smoke — it’s real demand, real activity.

I still stand bullish on ETH. This depeg is just a temporary stress test, and the chain keeps showing it's the most alive ecosystem out there.

PicksstETH колеблется, но уверенность ETH сильна как никогда

So yeah, we just saw a classic DeFi loop unwind — stETH depegged a bit as Aave’s WETH borrow rate spiked, triggering some forced unwinds and panic selling. Nothing new here. It's what you get when you pile leverage on top of leverage.

But zoom out — Ethereum just hit an all-time high in daily gas usage. That’s not just smoke — it’s real demand, real activity.

I still stand bullish on ETH. This depeg is just a temporary stress test, and the chain keeps showing it's the most alive ecosystem out there.

00:00

00:00